CALL NOW & SCHEDULE TODAY

Our Blog

Here you will find free financial tips and actionable items that can help you make better financial decisions, and get you on the path to financial independence. Here's to your success!

Raising Money Savvy Kids: Age-Appropriate Activities for Every Stage

Hello, dear parents! Ever thought about how you can turn your little ones into money-savvy masters? It's never too early (or too late) to start teaching them about the wonders of managing money. Just like planting a tree, the best time to start was yesterday; the next best time is now! Let's dive into a journey of financial wisdom, tailored for every age, that's as fun as it is educational.

I. Money Lessons for Toddlers (Ages 2-4)

These tiny tots are curious explorers. It's the perfect time to introduce the basics:

- Introduction to Coins and Bills: Let them play with toy money, feeling and seeing the different shapes and colors. It's like a treasure hunt with shiny coins and crisp bills!

- The Concept of Saving: A clear piggy bank works wonders. They’ll see their fortune grow coin by coin. Make it a nightly ritual, like a bedtime story but with saving.

- Fun Activities: Coin sorting can be a game—like matching socks but way more fun! Pretend shopping games can also spark their imagination and introduce basic transactions.

II. Financial Foundations for Young Children (Ages 5-7)

Now they're ready for the next level. Here, it's all about understanding the value of money:

- Understanding Value of Money: Simple chores for a small allowance. They’ll learn that money is earned. And what’s earned can be managed!

- Saving for a Goal: Set a target, like a new toy or a book. Watch them learn patience and determination as they save bit by bit.

- Interactive Games: Online games about money can be both fun and educational. Or play shopkeeper—let them sell and buy from their collection of toys.

III. Building Money Skills in Older Children (Ages 8-10)

As they grow, so should their financial knowledge:

- Earning, Saving, Spending: Introduce more complex chores. Let them make spending choices with their allowance. It’s like a mini-adult budget!

- Basic Banking: Time for their own savings account. Teach them about interest - it's like their money is having baby money!

- Real-world Applications: Involve them in grocery shopping on a budget. Or let them plan a family picnic, managing every penny.

IV. Preparing Preteens for Financial Independence (Ages 11-13)

These young minds are ripe for more advanced concepts:

- Advanced Allowance Management: Budgeting for bigger goals teaches them about delaying gratification. It’s not just saving; it’s strategizing.

- Introduction to Investing: Simple investment concepts, like a savings bond, can teach them about growth over time. Money can grow just like they do!

- Community Involvement: Teach them about charity and giving back. Show them that the value of money also lies in how it can help others.

Conclusion

Phew! That's quite the journey we've outlined. Remember, teaching kids about money isn't a sprint; it's a marathon. Patience and consistency are your best friends here. And trust me, the seeds you plant now will grow into a forest of financial wisdom for your kids.

We'd love to hear your stories and experiences. How have you introduced financial concepts to your kids? Share your tips and tricks!

And hey, don't forget to subscribe for more family financial planning tips. Share this post with your friends and family - let's spread the word about raising money-savvy kids together!

Stay wise and wonderful, parents! Your journey in nurturing financially smart kids is not just a gift to them; it's a legacy you're building. Let's make it count! 🌟💰👨👩👧👦💪

FAQ Section

Q1: At what age should I start teaching my kids about money?

A1: Start as early as two years old! At this age, kids can begin to understand basic concepts like saving coins in a piggy bank. Remember, it's never too early to start.

Q2: How can I make learning about money fun for my kids?

A2: Turn it into a game! Use play money for younger kids, set up a pretend store, or use online educational games. The key is to make it interactive and enjoyable.

Q3: Should I give my child an allowance?

A3: Absolutely! An allowance is a great tool to teach kids about earning, saving, and spending responsibly. It's like their first step into the world of personal finance.

Q4: How can I teach my older kids about more complex topics like investing?

A4: Start with simple concepts like a savings bond or a basic savings account. Explain how money can grow over time. Use real-life examples to make it relatable.

Q5: Is it important to teach kids about charity and giving?

A5: Yes, it's crucial. Teaching kids about giving back helps them understand the value of money beyond just buying things. It fosters empathy and social responsibility.

Key Takeaways

1. Start Early: Introduce money concepts as early as possible in a way that's age-appropriate and fun.

2. Make It Practical: Use real-life scenarios like shopping, saving for a goal, or managing an allowance to teach financial lessons.

3. Encourage Saving: Teach kids the importance of saving, whether it’s in a piggy bank for younger kids or a savings account for older ones.

4. Discuss Earning and Spending: Help them understand that money is earned and should be spent wisely. Allowance is a great tool for this lesson.

5. Introduce Basic Investment Concepts: For older kids, simple investment ideas can help them understand how money can grow.

6. Teach About Giving: Instill the value of charity and generosity, showing them that money has the power to do good in the world.

Remember, the goal is to make financial learning a natural and enjoyable part of your child’s life, setting them up for a future of financial confidence and success!

Our mission at J&M Financial Services is simple: to empower families to achieve financial peace of mind. We achieve this by upholding values like integrity, trust, and an unwavering dedication to your financial success.

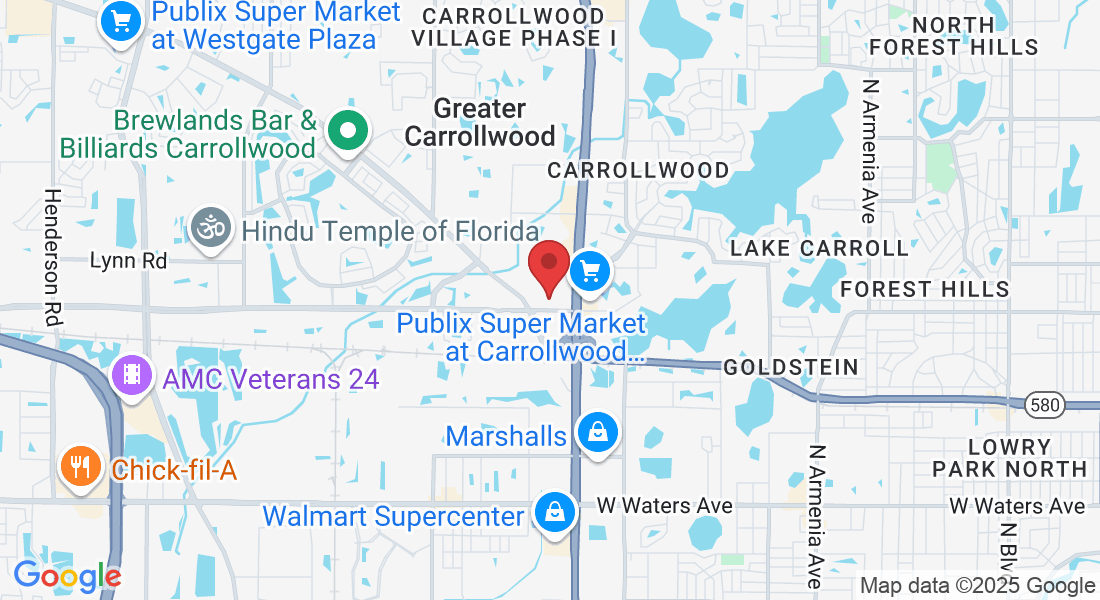

10008 N Dale Mabry Hwy

Ste 100-S

Tampa, FL 33618

888-681-7506

Copyright © 2025 J&M Financial Services - All Rights Reserved