CALL NOW & SCHEDULE TODAY

Our Blog

Here you will find free financial tips and actionable items that can help you make better financial decisions, and get you on the path to financial independence. Here's to your success!

10 Budget Hacks for Thriving Families: Ditch Debt & Embrace Fun

10 Budget Hacks for Thriving Families: Ditch Debt & Embrace Fun

Key Takeaways:

Meal Planning and Smart Shopping: Planning meals and sticking to a shopping list can significantly reduce grocery expenses. Embrace bulk buying and generic brands for added savings.

Second-Hand and Clothing Swaps: Utilizing second-hand stores and organizing clothing swaps are not only budget-friendly but also environmentally conscious choices.

DIY Fun: Engaging in DIY crafts and activities at home can be a cost-effective way to entertain your family, fostering creativity and bonding.

Leverage Community Resources: Local libraries and community events offer a plethora of free resources and activities, perfect for family entertainment without spending money.

Educate Kids About Money: Incorporating financial lessons into play and using educational games can help children learn the value of money in an enjoyable way.

Reduce Utility Costs: Simple habits like turning off lights and conserving water can lower utility bills, teaching kids valuable lessons about resource conservation.

Home Cooking: Cooking at home is not only economical but also an opportunity for family bonding and teaching children cooking skills.

Budget-Friendly Birthdays: Focusing on experiences and homemade gifts for birthdays can make them special without the high cost.

Savings for the Future: Encouraging the entire family to contribute to a savings plan can help build a financial cushion for future needs or goals.

For all the super moms out there juggling budgets and babies, this one's for you.

Introduction: Balancing the family checkbook can sometimes feel like a circus act, especially when little ones are in the mix. But fear not! Combining budget smarts with barrels of fun isn't just a dream. It's absolutely doable, and we're here to show you how.

1. Smart Grocery Shopping: Turn your grocery expedition into a treasure hunt. Plan meals, make a list, and stick to it. Think of bulk buys as your golden tickets to savings, and store brands as hidden gems. Your wallet will thank you, and your pantry will never be happier.

2. Embracing Second-hand and Swaps: Remember, one mom's outgrown onesie is another's treasure chest find. Dive into the world of second-hand stores and organize clothing swaps. It's budget-friendly, eco-friendly, and you might just make a friend or two along the way.

3. DIY Crafts and Activities: Who needs a pricey playground when you have imagination and glue sticks? Create a wonderland at home with DIY crafts and backyard adventures. These moments aren't just kind to your wallet; they're the seeds of cherished family memories.

4. Utilizing Local Libraries and Community Resources: Your local library is a goldmine of free fun – books, movies, story times, oh my! And don't forget about community events. They're like secret gardens of entertainment waiting to be explored, without spending a dime.

5. Budget-Friendly Travel Hacks: Who said memorable family trips have to drain your bank account? Embrace the great outdoors with camping, or discover the joys of a staycation. Scour the internet for family-friendly deals and embark on adventures that don’t cost the earth.

6. Teaching Kids About Money: Incorporate money lessons into playtime. Use games and apps to teach the value of a dollar. It’s like sneaking veggies into their spaghetti – they learn and grow without even realizing it!

7. Cutting Down Utility Costs: Turn saving energy into a family game. Who can be the quickest at turning off lights? Little changes can lead to big savings, and Mother Nature will be doing a happy dance too.

8. Affordable Home Cooking: The family that cooks together, stays budget-savvy together. Whip up simple, delicious meals and invite the kiddos to be sous-chefs. It's a recipe for fun, bonding, and savings all stirred into one.

9. Making Birthdays Special Without Breaking the Bank: Birthdays should be about balloons, not bills. Get creative with homemade gifts and heartfelt celebrations at home. The joy on their little faces will be worth more than the fanciest toy store haul.

10. Planning for the Future: Start a family piggy bank for those 'just in case' moments or future dreams. Teach the little ones the power of saving. It's like planting a tree – it takes time to grow, but the shade is worth it.

Conclusion: Navigating family finances while ensuring a boatload of fun is not only achievable, it can be a delightful journey. Each small step you take can lead to a sea of savings and a mountain of memories.

FAQ Section:

Q1: How can I make meal planning more efficient and cost-effective?

A1: Start by planning meals around what you already have in your pantry. Use apps or weekly sales flyers to find deals, and base your meal plan around these discounted items. Cooking in bulk and using leftovers creatively can also save time and money.

Q2: Are second-hand items really safe and hygienic for my kids?

A2: Absolutely! Most second-hand items can be easily cleaned or sanitized. Clothes can be washed, and toys or books can be wiped down. It's a safe and smart way to save money.

Q3: How can I find local community events that are family-friendly and free?

A3: Check your local library's bulletin board, community center, or city website. Social media groups and apps focused on local events are also great resources for finding family-friendly activities.

Q4: What are some simple ways to involve my kids in home cooking?

A4: Depending on their age, kids can help with washing vegetables, stirring ingredients, or setting the table. Make it fun by giving them 'special' tasks or turning cooking into a game.

Q5: How early should I start teaching my kids about saving money?

A5: It's never too early to start! Even preschoolers can learn about saving through simple activities like putting coins in a piggy bank. As they grow, you can introduce more complex concepts like budgeting their allowance.

Our mission at J&M Financial Services is simple: to empower families to achieve financial peace of mind. We achieve this by upholding values like integrity, trust, and an unwavering dedication to your financial success.

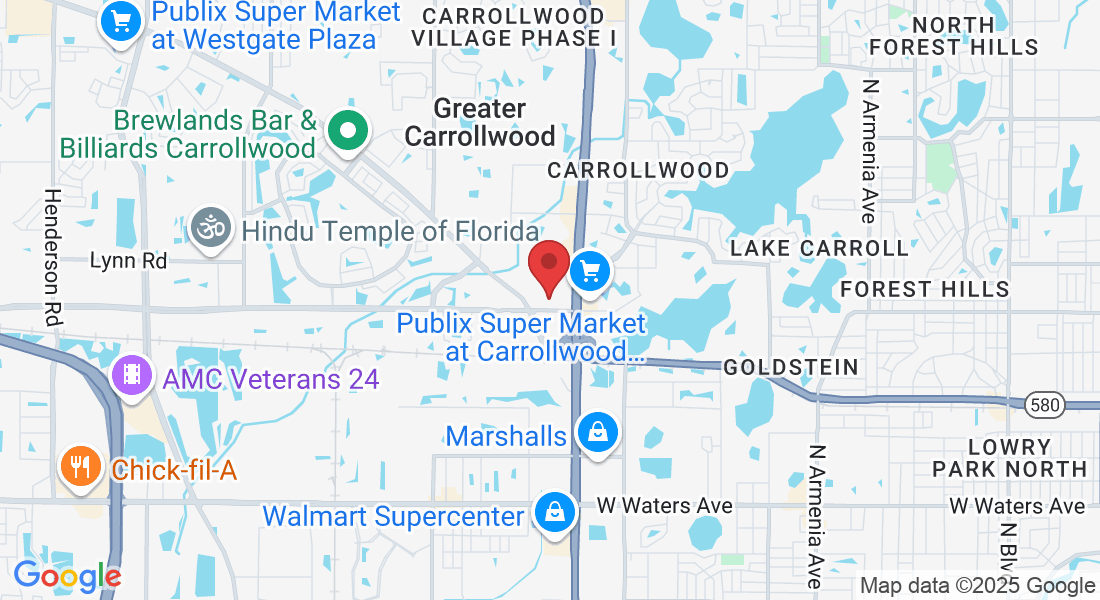

10008 N Dale Mabry Hwy

Ste 100-S

Tampa, FL 33618

888-681-7506

Copyright © 2025 J&M Financial Services - All Rights Reserved